Japan has a long history of alcohol consumption, with drinks like sake and shochu deeply ingrained in its culture. However, the country is experiencing a change in drinking habits. People are increasingly opting for healthier choices, leading to a rise in low-alcohol and non-alcoholic beverages. Now let’s get to the Alcohol trend in Japan.

Alcohol Trend in Japan

Non-alcoholic bars are also on the rise and seem to be popular among Generation Z. The trend is changing to one where people who drink and those who don’t drink can enjoy themselves in their way. The ways of enjoying alcohol are becoming more diverse. There has been a noticeable increase in the variety of craft beers, initially influenced by a boom in the United States, with domestic brands like Kirin’s Spring Valley actively participating. These craft beers, along with others like BREWDOG’s Neon Dream, are particularly appealing to younger demographics ,(20-30 yrs. old) including women.

Additionally, there is a growing trend of fruity shochu, like Daiyome with its lychee scent, and the rise of “non-sweet alcohol” options that pair well with meals, reflecting an increase in home drinking. Popular products such as Midori Gin Soda, Tako Highball, and sugar-free sours are gaining traction. There has been a rising popularity of Japanese wine, noting improvements in winemaking techniques, a variety of grapes, and the convenience of canned wines with single-serving sizes, which are easy to recycle.

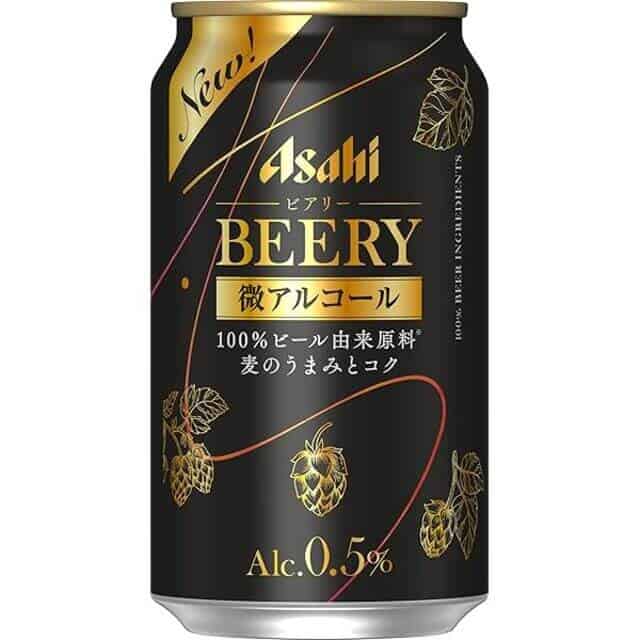

Low-alcoholic and non-alcoholic drinks

Low-alcoholic and non-alcoholic drinks are alcoholic beverages with very little or no alcohol, offering similar tastes without the buzz.

Suntory All-Free for the Body 350ml

Asahi Beer Asahi Super Dry Dry Crystal 350ml

Asahi Beer Bispa

Non-sweet alcohol

Non-sweet alcohol is alcoholic drinks that have a dry or less sweet flavor compared to sweeter options. In recent years, more and more people are concerned about carbohydrates, and non-sweet alcoholic beverages are the new trend this year.

Suntory Midori Gin Soda 350ml

Suntory Kodawari Sakaba no Tako Highball

Japanese Wine

Japanese Wine is a wine produced in Japan, often with unique grape varieties and flavors. Also keep an eye out for Japanese wine, the quality of which is constantly improving.

Chateau Mercian Aiakane 75ml

Craft beer

Craft beer is beer made by small independent breweries, focusing on unique tastes and ingredients. It is becoming more and more popular every year, and this popularity shows no signs of slowing down!

BREWDOG NEON DREAM

Kirin Spring Valley JAPAN ALE (Kaori)

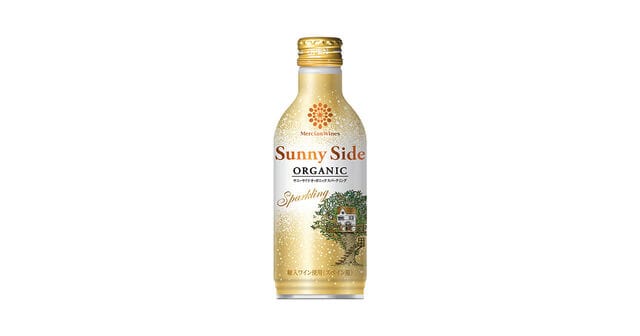

Canned wine

Canned wine is wine packaged in cans, convenient and perfect for on-the-go enjoyment. This also fits the trend towards sustainability, is on the rise!

Mercian Wines Sunnyside Organic Sparkling Can

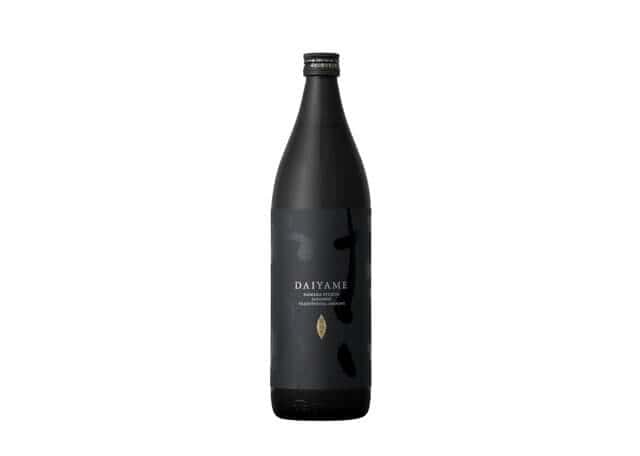

Fruity shochu

Fruity shochu is a Japanese distilled spirit with a sweet and fruity flavor, often enjoyed mixed with water or soda. You will also be enlightened to the deliciousness of shochu! Even those who have never tried it may become addicted.

Hamada Sake Brewery Daiyame ~DAIYAME

October for the New Law to take effect

In 2024, Japan’s alcohol market has seen significant changes, with a decline in sales of strong alcoholic drinks (around 9% alcohol content) that were once popular for being cheap and flavorful. This shift comes amid growing opposition to alcohol advertising in public spaces, and a new law taking effect in October will ban drinking on the streets in Tokyo’s Shibuya district. This is a move that many believe will soon be adopted in other areas like Shinjuku. The new revision on the Liquor Tax Law will also reduced the price of beer while increasing the cost of happoshu and third-category beer, leading to a unified tax rate by 2026.

What is happening in the Alcohol markets in Japan?

Strong chu-hai, a popular alcoholic beverage among young adults in Japan, is popular for its high alcohol content, affordability, and diverse flavors. However, in January 2024, the Ministry of Health, Labor, and Welfare issued guidelines to raise awareness about the widespread consumption of these strong drinks. As a result, beer companies like Asahi and Sapporo have drastically reduced their strong chu-hai product offerings.

At the same time, the demand for non-alcoholic beverages is on the rise. Suntory reported that the non-alcoholic beverage market grew by 2% in 2022 compared to 2021, marking a 40% increase over the past decade. Meanwhile, sales of strong chu-hai have significantly declined, dropping from ¥177.6 billion JPY ($1.1 billion USD) in 2020 to ¥136.5 billion ($853 million) in 2023.

Market Share and Trends by alcohols in Japan

Beer (37%)

- Spending: $39.9 billion

- Trend: There is a growing demand for craft beer, driven by consumers seeking unique and high-quality options. Brands like Kirin’s Spring Valley and BREWDOG’s Neon Dream are particularly appealing to younger demographics.

Shochu (24%)

- Spending: $25.9 billion

- Trend: Shochu remains a staple in Japanese culture, with a steady demand. There is also an increasing interest in premium and aged shochu varieties.

Sake (15%)

- Spending: $16.2 billion

- Trend: Sake continues to hold strong cultural significance. There is a trend towards premium sake and innovative packaging, making it more accessible to younger consumers.

Whisky (10%)

- Spending: $10.8 billion

- Trend: Japanese whisky is renowned globally, and its popularity continues to grow. There is a focus on high-quality, aged whiskies, and limited editions.

Wine (8%)

- Spending: $8.6 billion

- Trend: The quality of Japanese wine is improving, with a variety of grapes and convenient canned options. There is also a growing interest in organic and natural wines.

Other Spirits (6%)

- Spending: $6.4 billion

- Trend: Non-sweet alcohol options like Suntory Midori Gin Soda and Tako Highball are gaining traction. There is also an increasing preference for low-alcohol and non-alcoholic drinks, driven by health and wellness trends.

Total Market

- Total Revenue: $107.8 billion

- Total Volume: 8.21 billion liters

These figures reflect the combined revenue from both at-home and out-of-home consumption of alcoholic drinks in Japan. The market is expected to grow annually by 0.94% from 2024 to 2029.

Takeaway

Alcohol trend in Japan is changing, with a move away from traditional strong drinks towards low-alcohol and non-alcoholic options, driven by a shift towards healthier lifestyles. The industry is adapting with innovative products, though challenges like economic conditions and regulatory changes remain. Growth opportunities lie in niche markets and new beverage categories, with the future of the market depending on balancing tradition with innovation to meet evolving consumer tastes.

Comments